19th October 2022

We are delighted to report that over 100,000 children have now been supported through our community banking initiative, the Village Investors Programme (VIP)!

We are so proud to reach this milestone and to have seen the growth of the programme over the past eight years. Our Africa Director, Oswald Malunda, who has pioneered its delivery, shares his thoughts on this achievement.

Since WeSeeHope was founded in 2000, we have been striving to create sustainable change for vulnerable children across Southern and Eastern Africa through our community-led education, child rights and economic empowerment programmes.

Committed to having a holistic impact, a fundamental step in doing this is to work with parents and guardians to break the cycle of poverty in children’s homes. Without this, change will not last.

This is because a consistent problem found throughout rural and isolated communities in the five countries where we work is children missing out on their rights because their parents cannot earn enough money. Whether it’s dropping out of school to find work, or facing limited access to nutritious food or healthcare, it is all too often that they are unable to access the essential things they need for their development.

That’s why we decided to develop the VIP model and begin working with parents and guardians. Through six steps, the VIP establishes savings and loans groups for up to 30 members – the majority of whom are women – and teaches them how to pool their money together to form a community banking system.

With training in financial and entrepreneurial skills, members take loans from their group to start or expand their own business, and save their profits within the group.

Pictured are VIP groups in Malawi, Kenya and Zimbabwe.

The aim of the programme isn’t to create a solution overnight; it’s to kick-start a journey for parents and guardians so they can develop long-term security and a higher standard of living for their families. For example, for Maureen (pictured at the top of this blog), who is from Busia in Kenya, the money she saved helped her to build a new house with a sturdy iron roof, which will benefit her child for many years to come.

Harnessing the VIP model, members have launched a variety of exciting new businesses. For example, Oasis Pader, our incredible partner in northern Uganda, recently reported that members from 13 different groups are now running enterprises ranging from retail shops and restaurants, to bee-keeping businesses, mechanics workshops, and boda boda taxi companies.

Indeed, our data tells us that for every £1 we have invested in training and resources for VIP groups, they generate £3.88 through their businesses, almost quadrupling this initial investment!

Pictured is Charles, a member of one of the VIP groups supported by Oasis Pader in northern Uganda, with equipment from his new mechanics business.

We know that these businesses have the potential to make a huge difference.

By creating a platform for care providers to improve their household income, the VIP in-turn unlocks opportunities for their children to thrive. Among the many benefits, it means more money to pay for school fees, books and materials, improved access to healthcare and nutrition, and the ability to invest in safer housing and security, all of which help to address child rights issues driven by poverty.

Outside of members’ households, it drives activity that boosts local economies and provides direct support to other children in need of support. For example, by the time they graduate from the programme, every group is required to run their own Orphan Fund, a savings pot used to help children in their community who are in extreme need, paying for food, school fees and other necessities. Of the 100,000 children reached so far, over 32,000 of them are those supported though the Orphan Fund.

For Bahati and her husband, who are from Kimana in southern Kenya, their limited household income forced them to move two of their four children out of their home to live with her parents as they could no longer provide for them.

Talking about her situation, Bahati explains:

“Back in 2019, life was not easy for me and my husband. He was a casual labourer and I was a housewife. On a good day, he could bring home Ksh300/= (£2). This was not enough to support our basic needs, including the needs of our children, so we decided to take two of our children to stay with our parents for support.”

Soon after, Bahati heard about the VIP and joined her local group. “After a few weeks of saving and completing training on how to start, plan and manage a business, I took out a loan of Kshs 5,000/= (£36) and launched a hairdressing business.

“The business did better than I expected and I managed to repay the loan on time. At the end of the cycle, I received Ksh12,000/= (£86) during the group share out. I rented out a space at a shopping centre for Ksh1,500/= (£11), paid school fees arrears of Ksh2,500/= (£17.50) and the remaining Ksh8,000/= (£58) restocked my business. I thank God my business has grown, now I have two employees earning a commission of 20% for every job done. On a good day I can make up to Ksh3,000/= (£22). Now, after two years my business is worth approximately Ksh40,000/= (£287).

“My life has really changed. Now I have all my children back living with me. I truly appreciate those who make the VIP a success as it has changed our lives. My dream is to grow my business even bigger; one day I know I will own a beauty shop.”

Pictured is Bahati inside her salon with her two employees.

Bahati’s inspiring story is just one amongst over 34,000 other individuals who have started their own businesses, saved over £4,300,000, and created far-reaching benefits that have impacted over 100,000 children.

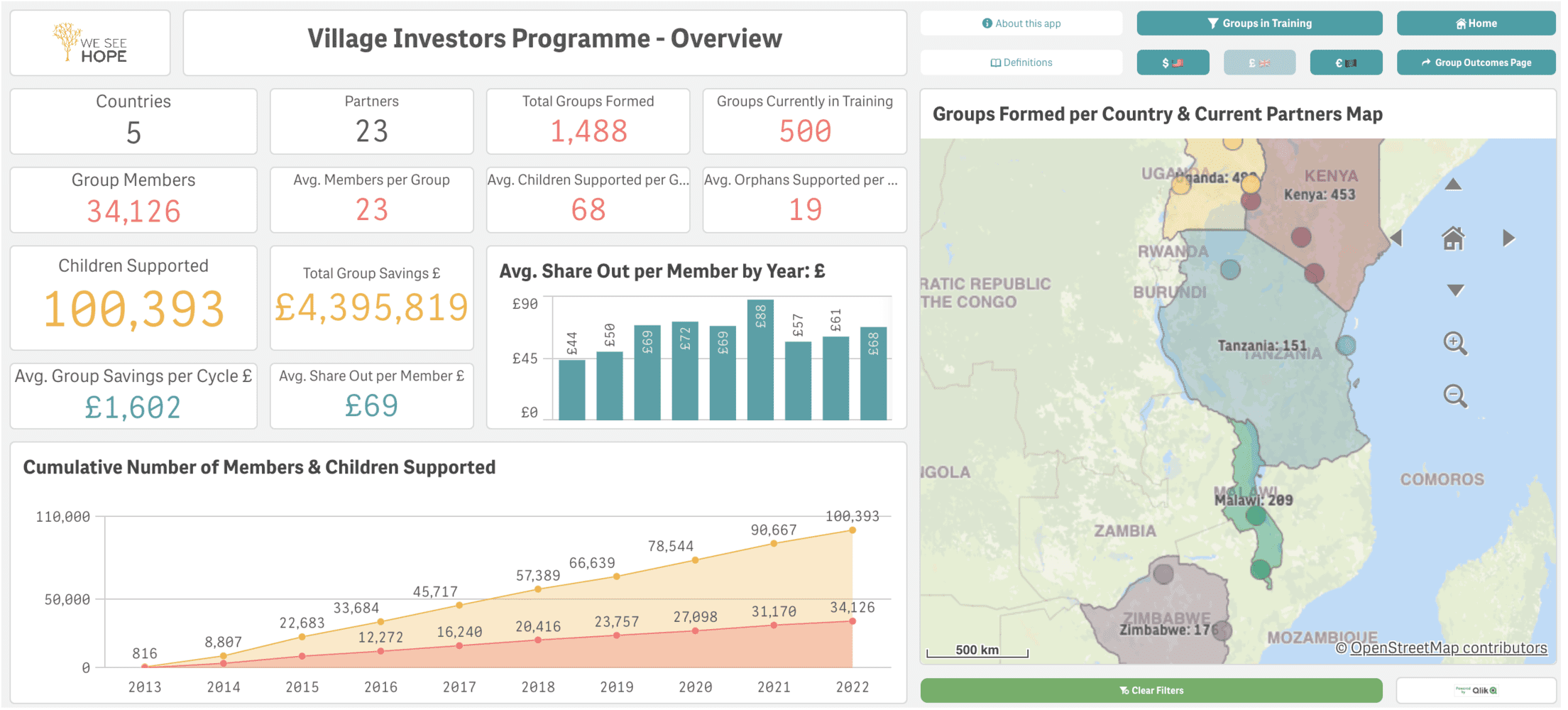

Thank you so much to all of our supporters who have been involved in the growth of the VIP since 2014. And thanks to our data dashboards developed alongside our partner Qlik.org, we are able to constantly monitor the progression of the VIP in real time – and you can too!

£30 is enough for a parent or guardian to become a member of a VIP group, be trained in savings and loans, business and financial skills, and unlock vast opportunities for their children. Please consider making a donation to support our work.